How To Choose A Point of Sale System

Point of Sale (POS) systems enable you to track sales and inventory, issue receipts, monitor employee productivity, and perform other back-of-house functions. Typically, when people talk about different POS systems, they're actually referring to the software within the system.

That software is usually client-based or cloud-based. Before you dive into features and choose the system that's right for you, let's understand them a little more.

Software Features

The reason you integrate a POS system into your business is to get paid for your products or services – but there are a variety of ways today that people can pay for goods.

The POS system you choose should be able to handle all the ways in which you might get paid: cash; debit and credit cards; checks; and contactless payment methods such as Apple Pay, Amazon Pay, or Google Pay.

If you're a brick-and-mortar, another thing to consider is the functionality of chipped cards. Chipped cards require the ability to "dip" the card, which means you'll need additional hardware to allow for the extra layer of security this feature provides. Some POS systems may charge extra for this.

Your POS system may also be able to integrate with other back-end applications, such as an inventory management system or customer relationship management software which can be used to store your contacts for marketing and other customer-relations management.

Once you understand the minimum functionality you're looking for in a POS system, you can dive into additional features that your business might benefit from, such as the ability to allow for returns, special pricing, gift cards, etc.

Additional Hardware

Most online businesses won't require a hardware component, but brick-and-mortar or mobile sales likely will. We live in an age of convenience and mobility, so a wireless "cash register" can help support a more customer-centric business model. You can add this technology to your setup pretty easily.

Most POS systems run on easily accessible tablets, phones, or laptops. To add the option of mobility, you can typically purchase dedicated hardware systems such as card readers, receipt printers, and barcode scanners right from your POS company. These systems work particularly well for expos, pop-up shops, or for associates that take payment on the floor.

Payment Processing

Payment processing – a must for modern businesses accepting credit and debit cards – is typically done through a third-party service. That service will likely cost you a percentage of your profit, though that percentage can be handled slightly differently depending on the company.

Square, a popular choice, offers its POS services for free with the stipulation that your payments are also processed through them. Other companies, such as Intuit QuickBooks or Shopify, charge a monthly subscription fee for their software and an additional fee for payment processing functionality. A third option, such as NCR Silver and Vend POS, are solely POS systems, but work with third parties to cover payment processing.

Back-Office Functionality

The additional functionality your POS system may offer can really enhance your back-of-house tasks. Depending on the software you choose, you could have access to inventory tracking as well as customer and employee tracking. This type of information can give you a pulse on how much inventory to purchase – even which colors or types.

By tracking what has been sold year-over-year, you will have a handle on what to expect. If a certain color always sells out, you'll have the data to plan for that in the future.

Pro tip: Make sure your POS system can function offline. Networks can go down at the most inconvenient times and you want to make sure you're covered even when you don't have internet access for a bit.

Tech Support

If your POS system crashes during a sale, how easy is it to get it back up and running? A support plan is key. It's important to understand a) how quickly support can help you, and b) is there a backup plan?

A backup solution is essential to keeping your business running if your network goes down. Ensuring that your vendor has your back in these situations is key, but knowing exactly how and where that support will come from is just as critical.

POS System Breakdown

Now that you know what to look for in a POS system to fit your company needs, review the pros and cons of a few of the most widely-used POS systems below.

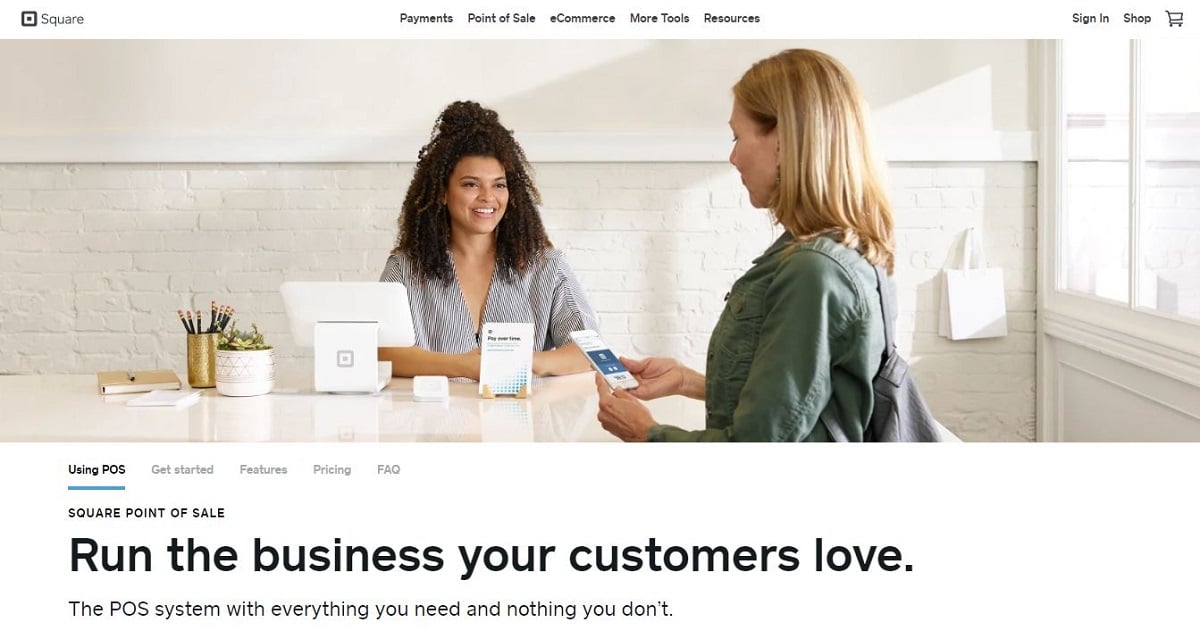

Square Point of Sale

Pros: Clear pricing at $0 per month and 2.6% + 10¢ per tap, dip, or swipe. Multiple customer support channels, hardware for swipe or dip options, works with both iOS and Android, and can run offline.

Cons: Lacks reporting and inventory management, and higher fees for larger organizations may occur.

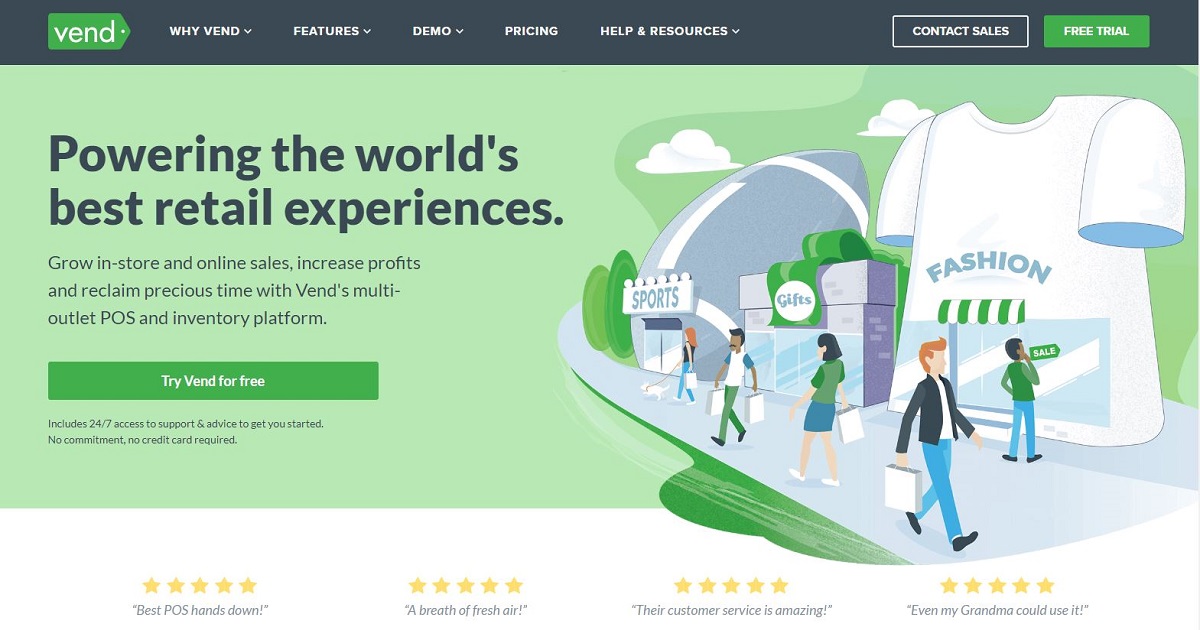

Vend POS

Pros: Clear pricing at $99/month billed annually or the Pro version at $129/month billed annually. Cloud-based system that runs on any operating system, various mobile sales functionality, and a 14-day free trial.

Cons: Does not offer its own payment processor (goes through third-party), does not offer email promotion functionality, and phone support may cost extra.

Bindo POS

Pros: Simple interface, back-office features available from register, and easy ecommerce implementation.

Cons: Pricing plans hidden until your trial ends or you contact the company. There's an activation fee, few partner services, and no 24/7 phone support.

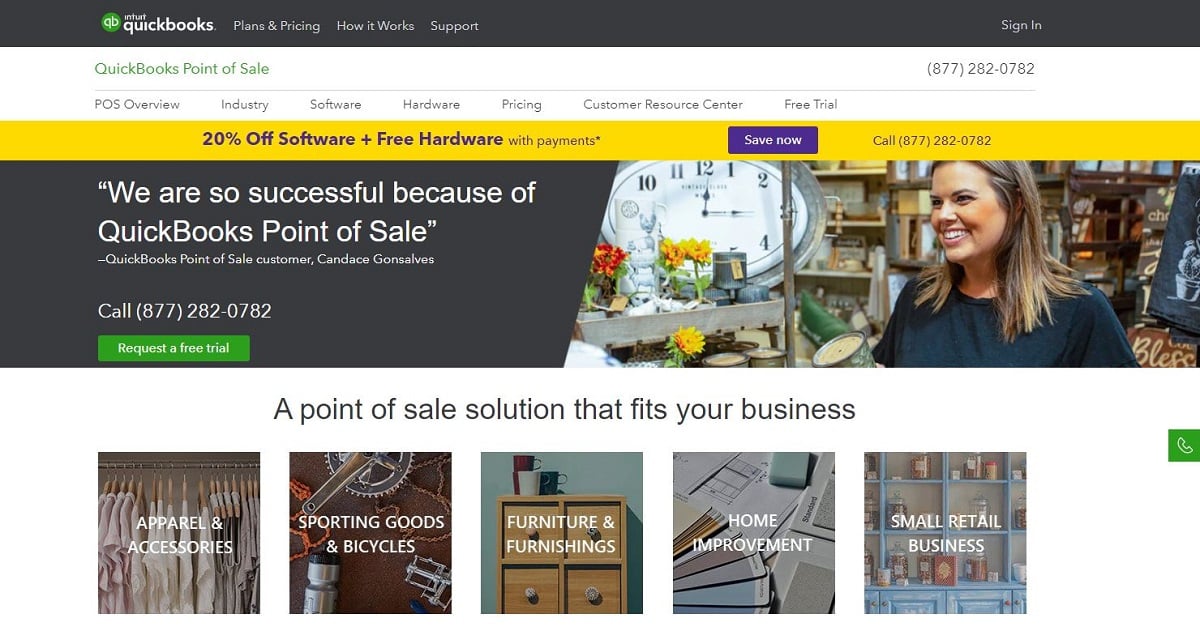

Intuit Quickbooks Point of Sale

Pros: One-time fee of $1,200, no monthly subscription. Integrates with QuickBooks system, 30-day free trial, and multiple payment plan choices.

Cons: No mobile options, customer-facing interface, or email marketing options.

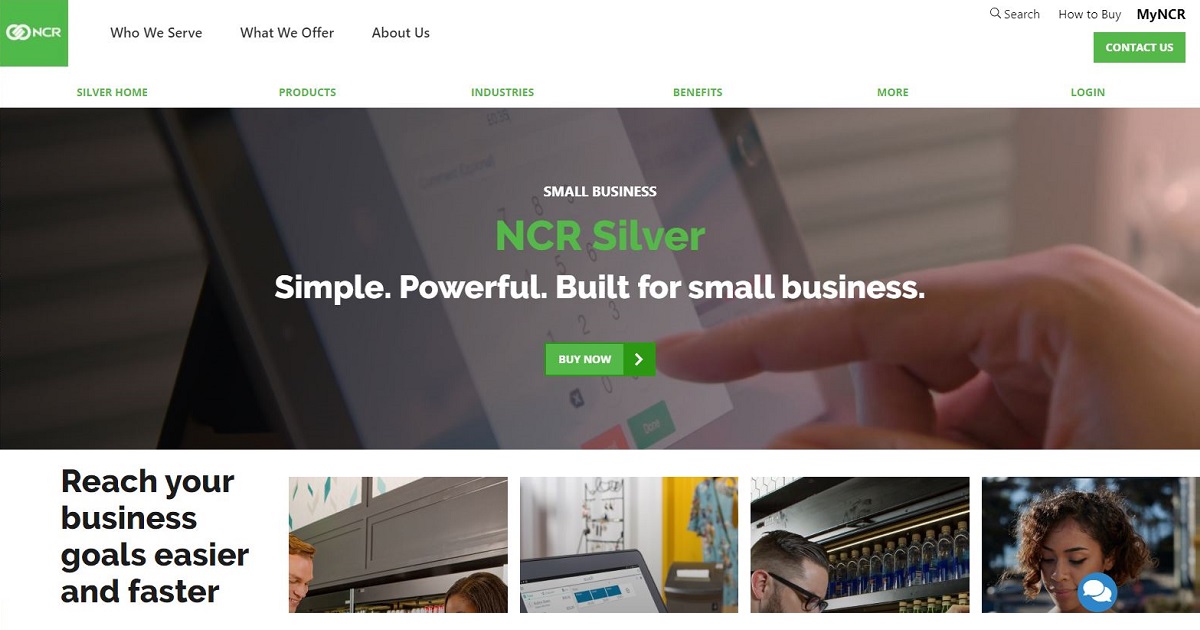

NCR Silver Point of Sale

Pros: Starts at $79/month and offers other options. Wide range of add-on products and features, works on mobile tablets, excellent 24/7 support and software training.

Cons: Does not offer payment processing, and the combination of add-ons can get expensive.

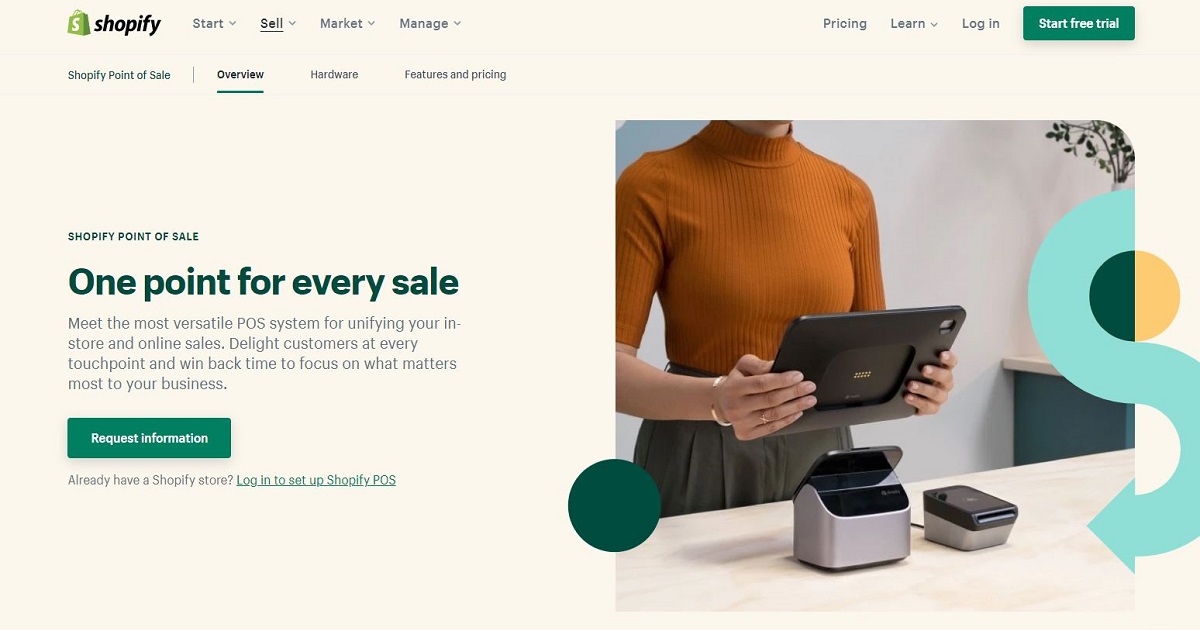

Shopify

Pros: Clear pricing tiers starting at $29/month. 14-day free trial, easy set-up, and easy-to-add on-site presence to a digital storefront. Customer support available.

Cons: Advanced features only available to higher-priced tiers, does not offer analytics or automatic sales/discounts.

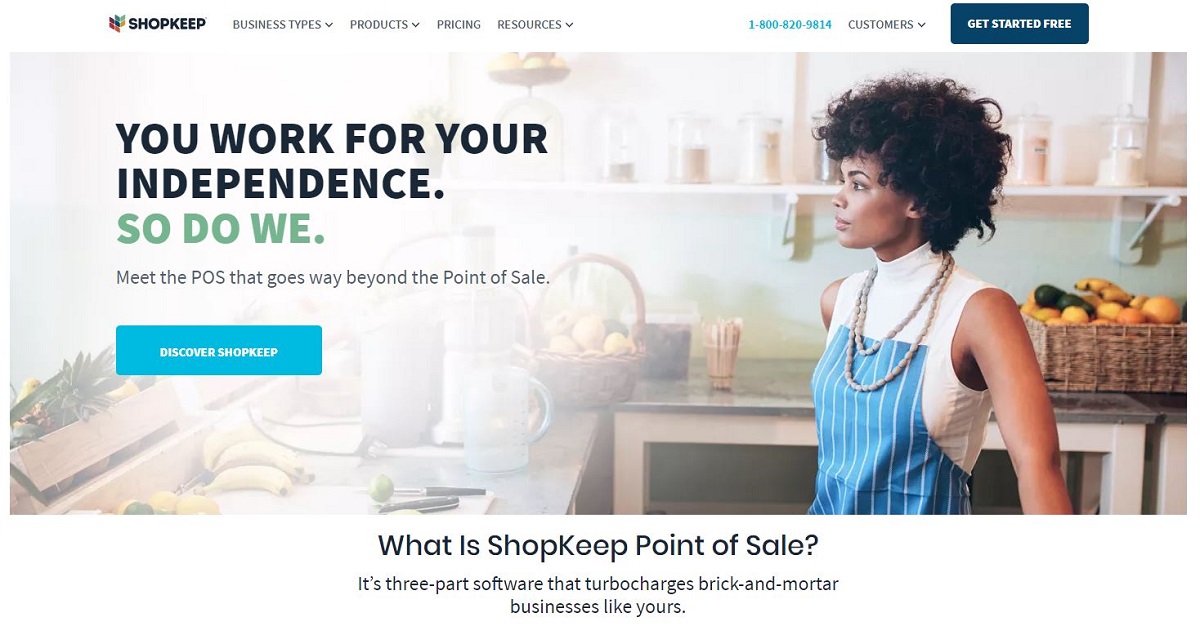

ShopKeep

Pros: Starts at $69 but must reach out for a quote. Apps for both iOS and Android phones offer real-time information. 24/7 support and easy-to-use interface.

Cons: No trial period and costs increase with add-ons.

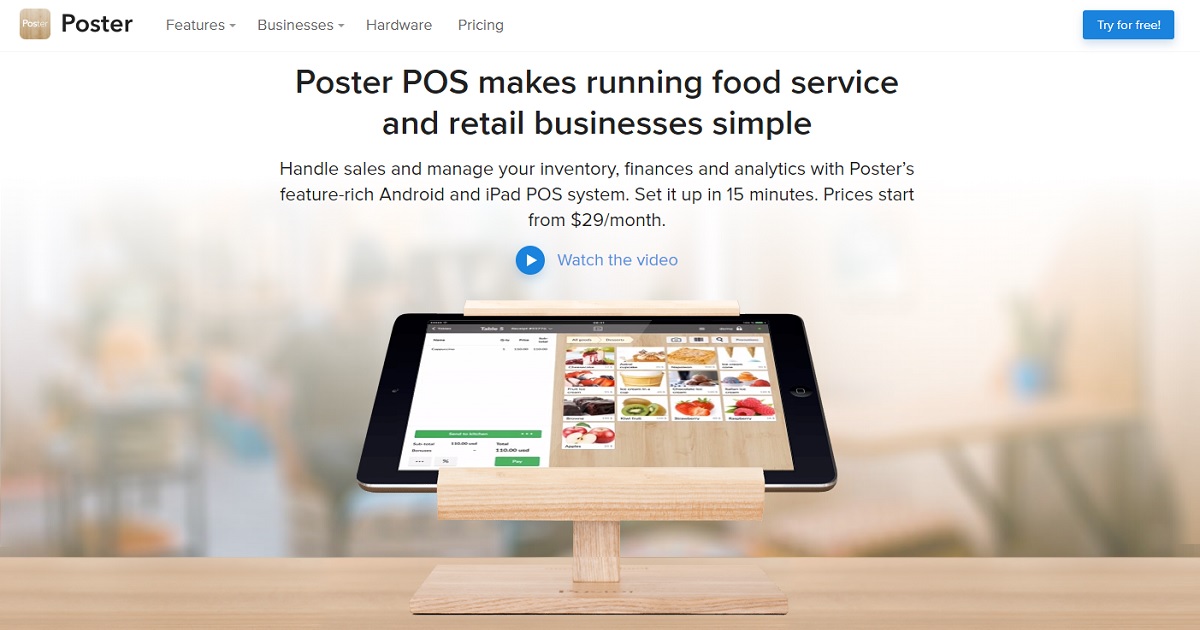

Poster

Pros: Plans start at $24/month billed annually, there's no contract, and the software is specially tailored to the restaurant/bar/shop industry.

Cons: Limited integrations and hardware is not included in the cost.

Find Your Fit

With so many options available, you need to think about your business needs to determine which of the various POS systems will fit best. The goal is to select an option that can accomplish your immediate needs as well as expand alongside your company as it grows product lines, services, and sale options.

Once you narrow down your search, talk to business representatives to make sure you've found your fit.

Keep your business growing and moving forward. Discover the best online website builder, benefits your small business may qualify for, and more helpful articles.

Don't forget to put your best foot forward with your products and packaging! Shop OnlineLabels.com for no minimum order quantities, thousands of label shapes and sizes, and free online templates that will make that part of the process a breeze.